Managing risk in crypto trading isn’t important — it's essential.

The volatile nature of the crypto market, with its frequent and unpredictable price swings, requires traders to adopt robust risk management strategies. Effective risk management helps protect your investments from significant losses and ensures that you can navigate the market's ups and downs with greater confidence.

The crypto market is known for its extreme volatility. Prices can surge or plummet in a matter of minutes, driven by various factors such as market sentiment, regulatory news, technological advancements, or macroeconomic events. Without proper risk management, traders can quickly find themselves exposed to substantial losses. By implementing risk management practices, you can safeguard your assets, minimise potential losses, and make more informed trading decisions. This not only helps preserve your capital but also allows you to take advantage of profitable opportunities with a clearer understanding of the risks involved.

Key Takeaways

- Effective risk management is essential for success in cryptocurrency trading.

- Secure wallets protect assets from theft and loss.

- Practicing on test accounts helps traders refine their strategies without financial risk.

- Hedging with futures contracts mitigates potential losses in volatile markets.

- CVEX’s Value-at-Risk (VaR) model provides a quantifiable measure of potential losses.

- Dynamic risk assessment ensures that margin requirements reflect current market conditions.

- Integrated TradingView tools enhance technical analysis and risk management.

What Is Risk Management in Crypto Trading?

Risk management in crypto trading involves identifying, assessing, and prioritising risks associated with trading digital assets. It encompasses a range of techniques and practices aimed at protecting capital, preserving profits, and managing exposure to potential losses. Given the inherent volatility and uncertainty of the crypto market, robust risk management strategies are crucial for long-term success and sustainability.

Risk management is a systematic approach to managing uncertainty and minimising potential financial losses. It involves several key steps:

- Risk Identification. Recognising the various risks involved in trading cryptocurrencies, such as market volatility, liquidity risk, cybersecurity threats, regulatory changes, and operational risks.

- Risk Analysis. Assessing the likelihood and potential impact of identified risks. This can involve quantitative methods like scenario analysis, stress testing, and sensitivity analysis.

- Risk Assessment. Prioritising risks based on their likelihood and impact, often using tools like risk rating scales or heat maps.

- Risk Treatment. Developing and implementing strategies to mitigate identified risks. This can include techniques like diversification, setting stop-loss orders, and using secure trading platforms.

Understanding and effectively managing these risks is vital for any trader looking to succeed in the crypto market. By adopting a structured risk management approach, traders can protect their investments, improve their decision-making processes, and enhance their overall trading performance.

Wallets and Trading Platforms

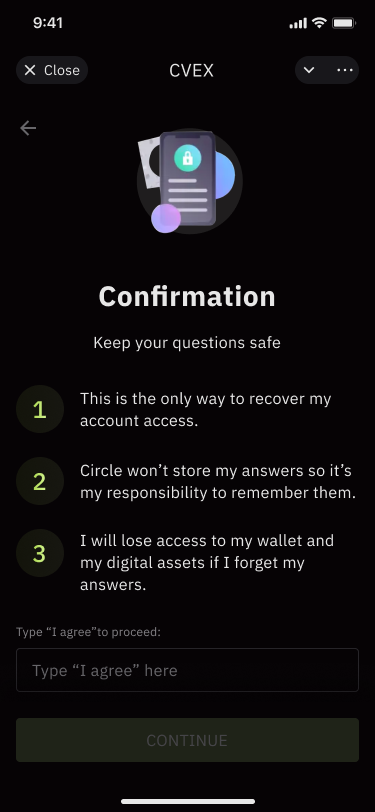

Secure wallets play a critical role in protecting your investments from theft, hacking, and other malicious activities. By securely storing your private keys and offering features like two-factor authentication (2FA), encrypted storage, and backup options, secure wallets ensure that your assets remain safe and accessible only to you.

Secure wallets offer several advantages that help safeguard your digital assets:

- Secure wallets use advanced encryption and security protocols to protect your private keys from unauthorised access.

- With secure wallets, you maintain full control over your funds, reducing the risk of loss due to exchange hacks or insolvency.

- Most secure wallets provide backup and recovery options, ensuring you can regain access to your assets in case of device loss or failure.

- Secure wallets often include privacy features that help keep your transactions and holdings confidential.

While secure wallets are crucial for protecting your assets, choosing the right trading platform is equally important. Different platforms offer varying levels of security, functionality, and user experience, which can impact your overall trading strategy and risk management.

First of all, let’s try to understand the differences between decentralised and centralised exchanges, which can help you make an informed decision:

Centralised Exchanges

These platforms are managed by a central authority or company. They offer high liquidity, user-friendly interfaces, and a wide range of trading pairs. However, they are also more susceptible to hacks and regulatory scrutiny, and users must trust the exchange with their funds.

Decentralised Exchanges (DEXs)

DEXs operate on blockchain technology and allow users to trade directly from their wallets without intermediaries. They offer enhanced security and privacy, but may have lower liquidity and less user-friendly interfaces compared to centralised exchanges.

To ensure maximum security and efficiency in trading, it is important to choose a platform that combines the best aspects of decentralised and centralised exchanges. CVEX offers robust security measures and a user-friendly trading environment.

How CVEX Ensures Security

At CVEX, security is a top priority, and the platform leverages several measures to protect traders and their assets:

- Crypto Wallets. CVEX uses decentralised crypto wallets, ensuring that users retain full control over their private keys and funds. This approach reduces the risk associated with centralised asset custody and provides enhanced security and privacy for traders.

- Secure Smart Contracts. The platform employs thoroughly vetted smart contracts, which are designed to be secure and resistant to hacking attempts. These contracts are regularly audited to maintain high-security standards, providing an additional layer of protection.

- Decentralised Infrastructure. CVEX operates on a decentralised infrastructure, further minimising the risks associated with centralised exchanges. This approach enhances the overall security and resilience of the platform, ensuring a safe trading environment for users.

By prioritising the use of secure wallets and robust smart contracts, CVEX provides traders with a safe and reliable environment for trading digital assets.

Risk Management in the Trading Process

This section explores key strategies and tools that traders can use to manage risk and enhance their trading outcomes. We will delve into the importance of the risk/reward ratio, the use of take profit and stop loss orders, and the creation of a comprehensive trading plan. Additionally, we will highlight how CVEX supports traders with advanced features designed to bolster risk management practices. By mastering these concepts and utilising the tools available on CVEX, traders can approach the crypto market with greater confidence and resilience.

Risk/Reward Ratio

This ratio helps traders evaluate the potential profit of a trade relative to its risk, ensuring informed decision-making and strategic planning.

How to Calculate Risk/Reward Ratio?

- Determine Risk. Calculate the risk amount by subtracting the stop-loss level from the entry point.

Example: If the entry point is $50,000 and the stop-loss level is $48,000, the risk amount is $2,000.

- Determine Reward. Calculate the reward amount by subtracting the entry point from the target price.

Example: If the target price is $56,000 and the entry point is $50,000, the reward amount is $6,000.

- Calculate the Ratio. Divide the risk amount by the reward amount to get the risk/reward ratio.

Example: $2,000 / $6,000 = 1:3.

A favorable risk/reward ratio, such as 1:3, indicates that the potential reward outweighs the risk, making the trade more attractive.

Take Profit and Stop Loss

Implementing take profit and stop loss orders is crucial for managing risk and securing profits in the volatile crypto market.

Take Profit Orders

Take profit orders automatically close a trade when the price reaches a predetermined level, locking in gains. This prevents traders from holding onto a winning position for too long, which could result in a reversal and loss of profits.

Stop Loss Orders

Stop loss orders automatically close a trade when the price drops to a specified level, limiting potential losses. This is essential for managing downside risk and protecting capital from significant market movements.

By setting take profit and stop loss levels, traders can manage their trades more effectively, ensuring they lock in gains and minimise losses.

Creating a Trading Plan

A well-defined trading plan is essential for consistent and disciplined trading. This plan should outline the trader’s strategies, risk management rules, and performance goals.

Components of a Trading Plan

- Entry and Exit Points. Clearly define levels for entering and exiting trades based on market analysis.

- Risk/Reward Ratios. Ensure each trade has a favorable risk/reward ratio to maximise profitability.

- Stop Loss and Take Profit Levels. Set predefined levels to manage risk and secure profits.

- Position Sising. Determine the sise of each trade based on the trader’s risk tolerance and account sise.

- Performance Review. Regularly review trading performance to identify strengths and areas for improvement.

By adhering to a structured trading plan, traders can maintain discipline, manage risks effectively, and enhance their overall trading performance.

How CVEX Can Help?

CVEX offers several features and tools to help traders manage risk effectively and improve their trading strategies.

Integrated Trading View

CVEX integrates Trading View, providing traders with advanced technical analysis tools. These tools include risk/reward calculators, charting tools, and technical indicators that help traders make informed decisions and manage risks.

Secure Trading Environment

CVEX ensures a secure trading environment with decentralised wallets and secure smart contracts. This enhances the safety of traders’ assets and minimises the risk of hacks and unauthorised access.

Test Accounts for Practice

CVEX offers a testnet that allows traders to practice their trading strategies without risking real capital. This enables traders to refine their strategies, test different risk management techniques, and gain confidence before trading on the mainnet.

Weekly Email Analytics

CVEX provides weekly email analytics with market news and insights, helping traders stay informed about market conditions and make better fundamental analysis decisions.

Hedging Portfolio with Futures

Hedging is a crucial aspect of risk management, while futures contracts are a powerful tool for hedging. They allow traders to protect their portfolios from adverse price movements. This section explores how futures can be used effectively for hedging and the specific benefits offered by CVEX’s classic futures contracts.

Futures for Hedging

Futures contracts are standardised financial agreements to buy or sell an asset at a predetermined price on a specific future date. They are widely used for hedging in various markets, including cryptocurrencies, due to their ability to lock in prices and create offsetting positions. By taking an opposite position in the futures market, traders can mitigate the risk of price movements in their primary holdings.

Classic futures offer several benefits for hedging, including price stability, predictability, and flexibility. They allow traders to secure current prices and protect their investments from unfavorable market shifts. This predictability is particularly valuable in the highly volatile cryptocurrency market, where prices can fluctuate rapidly.

But you need some examples, right?

Short Hedge: Farmer Example

A farmer plants wheat in the fall, anticipating harvest next summer. To protect against falling wheat prices, the farmer sells wheat futures contracts at the current price. If the market price drops by harvest time, the farmer’s loss in the physical wheat market is offset by gains in the futures market, effectively locking in the original price.

Long Hedge: Baker Example

A baker anticipates needing wheat next year and worries about rising prices. To hedge against this risk, the baker buys wheat futures contracts. If wheat prices rise by the time the baker needs to purchase the wheat, the increased cost in the physical market is offset by gains in the futures market, ensuring stable pricing for the baker’s ingredients.

How to Hedge Your Portfolio Using CVEX?

CVEX’s classic futures contracts allow traders to lock in prices, providing predictability and security in uncertain market conditions. This helps in mitigating the risk of significant price fluctuations that could impact the value of a trader's portfolio.

Consider a scenario where you hold a significant amount of ETH in your wallet. You are concerned that negative news might trigger a sharp decline in ETH’s price. To hedge against this risk, you decide to use CVEX’s platform to short a correlated asset, such as BNB, which often moves in tandem with ETH.

- Start by identifying assets that typically move in the same direction as your primary asset. In this example, ETH and BNB are correlated.

- Move a portion of your funds to your CVEX trading account to facilitate the hedging process.

- Use the funds to open a short position in BNB futures on the CVEX platform. This means you are betting that the price of BNB will fall.

- Due to CVEX’s high leverage options, you don’t need to match the full value of your ETH holdings with an equivalent BNB position. A smaller, leveraged position can effectively hedge your portfolio. For instance, if you have $10,000 worth of ETH, a $1,000 short position in BNB futures with 10x leverage can provide substantial protection against potential losses.

Benefits of Using CVEX’s Classic Futures for Hedging

- Price Stability and Predictability: By locking in prices with futures contracts, you gain predictability and security, mitigating the risk of significant price fluctuations.

- Flexibility in Risk Management: Classic futures on CVEX allow you to manage both long and short positions across various assets, including cryptocurrencies and, in the future, commodities like metals and oil.

- Comprehensive Coverage: With a wide selection of assets and plans to expand into different markets, CVEX provides ample opportunities for effective hedging.

Practising with Test Accounts

Practicing with test accounts is an essential step for any trader, especially in the volatile world of cryptocurrency trading. It allows traders to develop and refine their strategies without the risk of losing real money. The importance of practicing with test accounts lies in the opportunity it provides to learn the intricacies of trading, understand market dynamics, and test strategies without financial risk. This risk-free learning environment helps traders build confidence and understand how various market mechanisms work.

Paper trading, or simulated trading, involves executing trades in a virtual environment that mimics real market conditions without using actual funds. This practice is invaluable as it allows traders to develop and fine-tune their trading strategies in a safe environment. By experimenting with different approaches, traders can identify what works best and make necessary adjustments. New traders, in particular, can build confidence in their trading abilities by practicing in a simulated environment and seeing the results of their strategies without the fear of financial loss.

CVEX offers a comprehensive testnet environment where traders can practice their trading strategies without risking real capital. This testnet replicates the live trading environment, providing realistic market conditions and access to all trading tools and features available on the mainnet. To use the CVEX testnet, traders first need to sign up on the CVEX platform and navigate to the testnet section. They should then connect their crypto wallet to the CVEX testnet and ensure they have test funds, which can be provided by the platform for simulated trading.

Once connected, traders can familiarise themselves with the various features of the CVEX platform, including the trading interface, charting tools, and order types. CVEX integrates TradingView, offering advanced technical analysis tools such as risk/reward calculators and various charting options. Using the testnet, traders can develop and test their trading strategies, experimenting with different approaches and analysing the performance of their trades. The analytics and reporting tools provided by CVEX help traders assess the effectiveness of their strategies and make data-driven adjustments.

The integration of TradingView into CVEX offers several benefits for technical analysis. TradingView provides advanced charting tools, a variety of chart types, and customisable indicators that help traders analyse price trends and identify patterns. Technical indicators such as moving averages, RSI, MACD, and Bollinger Bands allow traders to make informed decisions based on quantitative data. Drawing tools for trend lines, support and resistance levels, and other annotations are essential for technical analysis, while real-time data ensures that analysis is based on the most current market conditions.

Using CVEX’s testnet, coupled with the advanced tools provided by TradingView, traders can practice and refine their trading strategies in a risk-free environment. This preparation is crucial for effective risk management and achieving long-term success in cryptocurrency trading.

Wrapping Up

Effective risk management is crucial for navigating the volatile crypto market. By utilising secure wallets, practicing on test accounts, and employing hedging techniques with futures, traders can significantly mitigate risks. CVEX enhances these efforts with its Value-at-Risk (VaR) model, dynamic risk assessment tools, and integrated TradingView features, providing a comprehensive suite of tools to help traders manage their portfolios effectively and achieve greater stability and success in their trading endeavors.

.svg)