The advent of CeFi (Centralised Finance) and DeFi (Decentralied Finance) marks a pivotal shift from traditional finance models to more inclusive and accessible systems. This transformation is not just a technological leap but a response to the growing demand for transparency, efficiency, and autonomy in financial transactions.

Historically, financial systems have been built on centralised models, with banks and financial institutions acting as the gatekeepers of money and credit. These entities, governed by a complex web of regulations, have controlled the flow of money, the issuance of credit, and the management of financial risks. However, this centralisation has often led to inefficiencies, exclusivity, and a lack of transparency, prompting the search for alternative finance models.

Enter CeFi and DeFi, two paradigms that challenge the status quo of traditional finance. CeFi, or Centralised Finance, refers to the crypto-equivalent of traditional banking systems, where exchanges and platforms act as centralised entities offering various financial services. These services include but are not limited to, trading, lending, borrowing, and yield farming, all under the oversight of a central authority. CeFi platforms bridge the gap between the legacy financial system and the burgeoning world of digital assets, providing users with familiar interfaces and regulated environments.

On the other hand, DeFi, or Decentralised Finance, represents a radical departure from conventional financial operations. Built on blockchain technology, DeFi offers a suite of financial services that operate without central intermediaries. From decentralised exchanges (DEXs) to lending protocols and stablecoins, DeFi utilises smart contracts to automate financial transactions, offering unparalleled transparency and control to users. This shift towards decentralisation seeks to democratise finance, making it more accessible and equitable for all participants.

The emergence of CeFi and DeFi as responses to the limitations of traditional finance is a testament to the dynamic nature of the financial industry. By addressing issues such as accessibility, transparency, and user control, these models are reshaping our understanding of financial systems in the digital age. As we delve deeper into the distinctions, advantages, and challenges of CeFi and DeFi, it becomes clear that the future of finance is on the cusp of a transformative era, promising more inclusive, efficient, and transparent financial services for individuals worldwide.

Understanding CeFi: Centralised Finance in Crypto

Centralised Finance (CeFi) within the cryptocurrency domain acts as a pivotal bridge connecting traditional financial mechanisms with the rapidly evolving digital currency landscape. Rooted in age-old principles, CeFi today melds with modern technology to offer an array of financial services while maintaining centralised governance. This blend represents a continuum from tangible assets to digital currencies, illustrating humanity’s pursuit of stable and dependable financial infrastructures.

CeFi’s cornerstone is centralised exchanges (CEXs), which funnel all trading activities through a singular platform under centralised oversight. Prominent examples include Binance, Coinbase, and Kraken, which display CeFi’s role in cryptocurrency, providing a unified venue for trading, lending, and borrowing. These platforms, acting as custodians, assume the responsibility of securing and managing users’ funds. Beyond trading, CeFi extends to services like lending, borrowing, and margin trading, enriching the cryptocurrency experience.

Advantages of CeFi include:

- Enhanced Security: CeFi platforms invest in sophisticated security measures to protect users’ assets from cyber threats.

- Robust Customer Service: Provides comprehensive support to users, facilitating a smoother navigation through the complexities of crypto trading.

- Regulatory Compliance: CeFi entities adhere to legal frameworks, offering an added layer of protection against potential fraud and malpractices.

Challenges faced by CeFi comprise:

- Security Risks: Despite robust security measures, centralised platforms remain prime targets for hackers, evidenced by past security breaches resulting in significant financial losses.

- Control Over Funds: The centralised nature of CeFi means users relinquish direct control over their funds, raising concerns about autonomy and the risks of mismanagement.

- Privacy Concerns: Utilising CeFi platforms often entails disclosing personal information, potentially compromising user anonymity.

In essence, Centralised Finance in the cryptocurrency arena marries traditional financial systems with technological innovation. It provides a regulated and familiar environment for trading and asset management, backed by a suite of services catering to various user requirements. Nevertheless, it necessitates a judicious assessment of its benefits against inherent risks and challenges. As the cryptocurrency landscape continues to mature, CeFi remains a critical component, steering the course of digital finance with its blend of security, innovation, and regulatory alignment.

Diving into DeFi: The Decentralised Finance Revolution

Decentralised Finance (DeFi) represents a revolutionary shift in the financial domain, challenging the centralised banking systems’ status quo by leveraging blockchain technology and smart contracts. This innovative framework democratises finance, making it accessible, transparent, and inclusive. DeFi stands out for its ability to offer a comprehensive suite of financial services — from asset exchanges to loans and leveraged trading — without the intermediation of traditional financial institutions.

The Role of Blockchain and Smart Contracts in DeFi:

Blockchain serves as the backbone of DeFi, ensuring transparency, security, and efficiency. It enables transactions and agreements to be executed automatically through smart contracts, without needing central authorities or intermediaries. This technology not only reduces the potential for human error but also significantly cuts down transaction costs and time.

Services Provided by DeFi:

DeFi platforms have rapidly expanded their offerings, covering a wide range of financial services that mirror those in the traditional financial sector. These include but are not limited to:

- Asset Exchanges: Decentralised platforms facilitating direct peer-to-peer asset trading.

- Loans: Permitting users to lend or borrow cryptocurrencies, often secured by digital assets.

- Leveraged Trading: Allowing traders to amplify their trading positions using borrowed funds.

Unique Features of DeFi:

DeFi’s allure lies in its core features:

- Transparency: Every transaction and its rules are recorded on the blockchain, visible to anyone.

- Control: Users retain full control over their assets without relying on third parties.

- Accessibility: DeFi services are accessible to anyone with an internet connection, breaking down geographical and socio-economic barriers to financial services.

Advantages of DeFi over CeFi:

DeFi ushers in a new era of financial empowerment and innovation. It offers unparalleled transparency, where users can directly interact with financial systems and products without opaque practices. Additionally, DeFi promotes financial inclusion and user empowerment, allowing individuals to participate in a wider array of financial activities with minimal entry barriers.

Risks Associated with DeFi:

Despite its potential, DeFi is not without risks:

- Asset Security: The nascent stage of many DeFi platforms can pose security risks, from smart contract vulnerabilities to platform exploits.

- Platform Reliability: As decentralised platforms are still in development, they may face issues with scalability, user experience, and reliability.

- Regulatory Ambiguity: The lack of clear regulatory frameworks for DeFi can create uncertainties for users and developers, potentially affecting its mainstream adoption.

In summary, DeFi represents a paradigm shift in finance, challenging traditional centralised systems with its innovative use of blockchain technology to offer transparent, accessible, and user-controlled financial services. While it promises a future of empowered financial participation, it also necessitates cautious navigation of its associated risks. As the DeFi space continues to evolve, it is poised to redefine the financial landscape, promising more inclusive and innovative solutions.

CeFi vs. DeFi: A Comparative Analysis

The financial ecosystem is witnessing a transformative period with the coexistence of Centralised Finance (CeFi) and Decentralised Finance (DeFi), each presenting unique advantages and challenges. This comparative analysis delves into the core differences and similarities between CeFi and DeFi across multiple dimensions, shedding light on the evolving landscape of finance.

Public Verifiability and Transparency:

DeFi, built on blockchain technology, excels in public verifiability and transparency. Every transaction and contract execution is recorded on the blockchain, accessible for anyone to audit. This contrasts with CeFi, where operations are more opaque, often leaving users in the dark about the internal workings and decisions affecting their assets.

Atomicity and Execution Speed:

DeFi transactions can be programmed to be atomic, meaning they either complete in their entirety or not at all, reducing the risk of partial execution. However, DeFi can sometimes suffer from slower execution speeds due to network congestion. CeFi, operating on traditional digital infrastructures, often provides faster transaction speeds but lacks the inherent atomicity of blockchain transactions, relying instead on legal agreements to ensure transaction integrity.

Development and Deployment Anonymity:

DeFi platforms often embrace development and deployment anonymity, allowing for the creation and operation of financial services without revealing the identities of the developers. This level of anonymity is rare in CeFi, where companies are typically bound by regulatory requirements to disclose significant amounts of operational and ownership information.

Custody and Control Over Assets:

One of the most pronounced differences lies in the approach to asset custody. DeFi grants users full control over their assets through non-custodial wallets and smart contracts, contrasting with CeFi’s custodial nature, where users entrust their assets to the platform. This fundamental difference highlights the trade-off between the convenience of CeFi and the sovereignty provided by DeFi.

Market Hours and Availability:

DeFi markets operate 24/7, facilitated by the always-on nature of blockchain networks, offering continuous trading without the constraints of traditional market hours. In contrast, CeFi markets may have specific operating hours, influenced by their geographical location and regulatory environment.

Interplay and Blurred Lines:

The distinction between CeFi and DeFi is not always clear-cut. The financial ecosystem is increasingly witnessing a convergence of practices, with CeFi platforms incorporating blockchain technologies and DeFi principles to enhance transparency and efficiency. Conversely, some DeFi projects are exploring centralised elements to improve user experience and regulatory compliance.

In essence, CeFi and DeFi represent two sides of the same coin, offering diverse paths to financial innovation and inclusion. While DeFi pushes the boundaries of decentralisation and user empowerment, CeFi provides a familiar, regulated framework for financial services. The future of finance may well lie in the synergies between these two paradigms, leveraging the strengths of each to create a more inclusive, efficient, and transparent financial system.

Legal, Security, Economic, and Privacy Perspectives

CeFi operates within a well-established legal framework, adhering to regulatory standards that cover licensing, anti-money laundering (AML), and customer due diligence (CDD). In contrast, DeFi navigates a less clear regulatory landscape, leveraging blockchain’s global reach to offer financial services without centralised governance, raising questions about jurisdiction and legal compliance.

Security Challenges and Solutions

Security in CeFi hinges on the robustness of centralised platforms, which are frequent targets for cyberattacks but benefit from institutional-grade protection measures and insurance schemes. DeFi’s security is rooted in blockchain technology, offering resilience through decentralisation but facing challenges such as smart contract vulnerabilities. Both ecosystems are evolving with enhanced security protocols, including multi-factor authentication in CeFi and rigorous smart contract audits in DeFi.

Economic Implications

Transaction costs in DeFi are variable, primarily influenced by network congestion and demand for blockchain space, potentially leading to high fees during peak times. CeFi typically offers more predictable fees but can include costs like withdrawal fees and currency exchange charges. Regarding inflation, CeFi is tied to traditional fiat currencies subject to central bank policies, whereas many DeFi projects have predefined token supplies, introducing different economic dynamics.

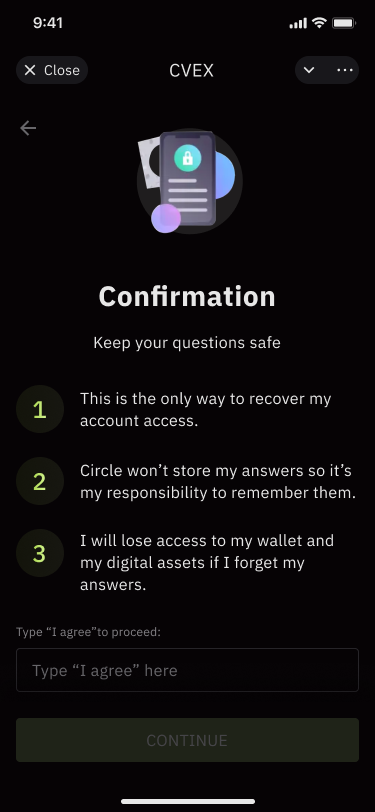

Privacy Considerations

CeFi requires user identification, compromising anonymity for regulatory compliance. DeFi, powered by blockchain, offers pseudo-anonymity, with transactions publicly recorded but not directly linked to real-world identities. However, the increasing integration of “Know Your Customer” (KYC) processes in DeFi projects begins to blur the lines of privacy between CeFi and DeFi.

Market Manipulation and Arbitrage Risks

CeFi markets are susceptible to traditional manipulation tactics but are monitored by regulatory authorities to protect investors. DeFi’s transparency and decentralised nature make manipulation more challenging but not impossible, with practices like front-running becoming prevalent due to public transaction pools and automated market making.

Arbitrage in CeFi involves exploiting price differences across different exchanges, often hindered by transfer times and fees. DeFi offers unique arbitrage opportunities within and across platforms, facilitated by instant blockchain transactions. However, the inherent risks of price slippage and transaction failures due to network congestion or smart contract issues apply. Both CeFi and DeFi arbitrageurs must navigate these challenges, weighing potential profits against the costs and risks of their strategies.

The Synergy between CeFi and DeFi

As the financial world evolves, it becomes evident that CeFi and DeFi are not adversaries but complementary forces shaping the future of finance. These two ecosystems have the potential to coexist harmoniously, leveraging their unique strengths to provide a more robust, inclusive, and versatile financial landscape.

Innovations such as bridges and cross-chain services are paving the way for seamless interaction between CeFi and DeFi platforms. These technologies allow assets and information to flow freely between different blockchains and centralised systems, unlocking new possibilities for liquidity, accessibility, and financial services. By integrating CeFi reliability and DeFi innovation, these solutions offer users the best of both worlds.

The financial ecosystem is witnessing the emergence of hybrid models that blend CeFi’s regulatory compliance and user-friendly interfaces with DeFi’s transparency and decentralisation. Such platforms are instrumental in introducing traditional finance users to the benefits of blockchain technology, fostering a gradual transition to more decentralised solutions.

Conclusion and Future Outlook

The journey through the realms of CeFi and DeFi uncovers a landscape rich with opportunity, innovation, and challenges. As we have explored, both systems possess distinct advantages that, when combined, have the potential to redefine financial interactions and accessibility.

The financial ecosystem continuously evolves, with CeFi and DeFi each playing critical roles in this transformation. As technologies advance and regulatory frameworks mature, we can anticipate a more interconnected and interoperable financial environment where users can effortlessly navigate between centralised and decentralised services according to their needs.

We encourage our readers to dive deeper into the worlds of CeFi and DeFi, exploring the diverse offerings on platforms like CVEX. Embrace the opportunity to engage with traditional and innovative financial solutions, expanding your understanding and capabilities within this ever-changing ecosystem.

Stay ahead of the curve by keeping informed about the latest developments in both CeFi and DeFi. As the lines between these two sectors continue to blur, being well-informed will enable you to make the most of the opportunities in this dynamic financial landscape.

.svg)