Crypto Valley Exchange (CVEX) stands out for its distinctive approach in the dynamic world of cryptocurrency trading. Contrary to the common trend, CVEX does not focus on perpetual contracts but instead emphasises the integration of expirable futures and options into its trading platform. This strategic decision stems from an in-depth understanding of perpetual contracts’ inherent limitations.

Understanding Perpetual Contracts and Their Shortcomings

Perpetual contracts, while popular in the crypto space, have notable disadvantages. They are often inefficient in capital utilisation, limiting their effectiveness in diverse trading strategies, particularly in hedging. This inefficiency is a barrier to the growth of a robust options market, as these contracts lack the necessary flexibility for various hedging tactics, including delta hedging.

Significant design issues and market risks overshadow the ease of implementing perpetual contracts within DeFi frameworks. Many protocols depend on failed trades to fund lending pools, a system that inherently favors retail failures over successes. This leads to skewed market risks and undermines the long-term value of these products for hedging. Additionally, the risk management models often result in imbalanced market conditions, posing risks for long-term hedges and potentially leading to market instability.

A Focus on Futures and Options

Recognising these challenges, CVEX has prioritised futures contracts and options in its offerings. These instruments are launched monthly and have a three-month lifespan, ensuring the availability of three active futures at any given time. This approach aligns with the platform’s commitment to providing diverse trading options, catering to different strategies and risk profiles.

Futures contracts on CVEX are meticulously designed to provide an edge to liquidity providers, with the bid-offer spread tailored to enable profitability. The final settlement of these contracts occurs on the last Friday of the expiry month, with a settlement fee designed to incentivise the closing of positions before the final settlement. This strategy reduces system load at settlement and minimises overall risk.

Options contracts on CVEX complement the futures schedule, offering a range of strike prices based on anticipated contract volatility. This structured approach allows traders to engage in various strategies, leveraging the dynamic nature of both futures and options markets.

Conclusion

CVEX’s commitment to not being a perpetuals DEX is a bold step toward more efficient and risk-managed crypto trading. By focusing on expirable futures and options, CVEX sets new standards for fusing traditional finance principles with decentralized finance innovation. This approach is about providing trading options and ensuring stability, efficiency, and risk management in the crypto trading landscape. Join us at CVEX as we redefine the future of cryptocurrency trading, where the focus is on sustainable growth and comprehensive risk management.

Latest posts

At first glance, all DeFi exchanges are similar. They all have bright interfaces, stock exchange glasses, charts, and a couple of “Buy” and “Sell” buttons. And the illusion is created as if the main thing has already been solved. But in reality, the deeper you look, the more it becomes clear: the beautiful interface is a showcase. And the real complexity is hidden in the backend.

After all, what makes an exchange a real infrastructure you can trust? Not buttons. Not tokens. It's the ability to ensure that every transaction actually happens and no one runs away with the money. That's what's called clearing. This is an invisible but critical process that checks, blocks, recalculates, and finalizes every position.

Clearing is the process that guarantees the execution of trades. It calculates how much you owe or receive, checks whether you have enough collateral, and locks up the right amounts. All this happens before and after each transaction so that there are no “forgotten debts” or “missing” counterparties.

Most DeFi platforms try to impress by showing off new features or gamification. But institutional participants look deeper: Can they trust the platform with millions of dollars, knowing that everything works predictably and smoothly?

At CVEX, we started with the hardest part, and we've already solved the clearing problem. Now we are moving on to the next height: high-speed order matching.

Why the Matching Engine Is the Key

A good stock exchange is like an orchestra. Someone has to conduct it so that all the notes sound in time. In the world of trading, this role is played by the order matching engine. It decides who trades with whom, at what price, and at what moment. Does that sound simple? In reality, one of the most complex engineering tasks in the industry.

For many years, there was a classic compromise: if you want speed, go to centralized systems; if you want transparency, sacrifice speed. Centralized engines (like on large CEXs) run in fractions of a second, but inside is a black box. How exactly do they make decisions? Why did order A execute before order B? There's no way to know. And frankly, they don't owe anyone an explanation.

On the other hand, decentralized exchanges give full transparency, but everything slows down. Every order goes through a blockchain where time is measured in slots and gas, not milliseconds. The result is slow, inconvenient, and almost unusable for algorithmic trading.

Our goal is to break this opposition. We're building an engine that gives you speed like CEX and confidence like DEX. Or as we call it, “CEX performance with DEX trust”. Fast, honest, verifiable. Not the illusion of decentralization is real.

CEX vs. DEX vs. CVEX — Comparative Table:

| Feature | Centralized Exchange | Typical DEX | CVEX |

|---|---|---|---|

| Matching Speed | High (~0.1s) | Low (~1–3s) | High |

| Verifi Ability | Low | High | High |

| Latency Transparency | Opaque | Clear | Clear |

| On-chain Auditability | None | Partial | Full |

For institutional players, it's not just nice to have. They won't bet millions on a system where they have to either wait three blocks for confirmation or trust in the honesty of some Amazon server. They want to see how the mechanism works and be sure that it won't fail at the right moment.

How to Build a Fast and Honest Matching Engine

When people talk about speed in trading, they often picture lightning-fast charts and shouts of “faster, faster!” in a hedge fund office. But in reality, it's not the external entourage that decides everything, but what happens in the machine's memory—yes, right in the RAM.

Our matching engine works the same way as the traditional market leaders Eurex, NASDAQ, and CME. All orders are stored and processed directly in RAM. It's called RAM-based CLOB (Central Limit Order Book), and it's the industry standard for speed.

Why is this important? Because the disk is slow. Even the fastest SSD can't compare to reading from RAM. When the market is moving, every millisecond counts. One glitch and you're no longer first in line. The algorithm misses, the trade fails, the trader is not happy, and you lose your reputation (and money).

The basis of the CVEX architecture:

- Memory instead of disk: All order data in RAM. No latency to write or read from disk.

- Target: 200k-300k events per second, like Eurex. This is not a fantasy, but an industry benchmark.

- Low-level implementation: C++ or Rust. No frameworks, maximum control over performance.

- Parallelism: The architecture is sharpened for multithreaded processing. All processor cores work on the result.

- Classic logic: Price and time priority, but with a performance that can withstand the load of pro-algorithm trading.

We don't just process orders quickly; we do it in such a way that no data stream becomes a bottleneck. There are no unnecessary layers. There is just speed, reliability, and predictability. Because serious market participants require engineering, not magic.

How to Be Fast but Trustworthy

Speed is a good thing. But in the world of crypto, “everything is fast” is not enough. The question any serious user will ask is, “How do I know you're not cheating?”

And it's a perfectly reasonable one. If the matching engine works outside the blockchain, where evidence is not published instantly, why should users believe it? The answer is simple: they shouldn't. And they won't. So we are building a system where believing is not necessary to verify.

We use a hybrid verification architecture that combines two approaches:

- Zero-knowledge proofs (zk-proofs): our engine regularly publishes on the blockchain a cryptographic proof that all matches were correct, without having to show each individual order.

- Optimistic verification: To increase speed, instead of waiting for proof for each action, we publish the result immediately and assume it is correct. But! If someone notices a mistake or an attempt to cheat, they can submit fraud proof, and the protocol will cancel the unfair result.

And now here's the best part: CVEX can use both approaches simultaneously.

First, instant publication of the result for fast trading. And then quietly confirming it via zk proof to record it with full confidence.

The bottom line?

- You get the speed of CEX.

- You get the transparency of DEX.

- No trades are left in a “black box”.

We don't ask you to trust. We just leave a trail for you to check everything.

Institutional Level Without Compromise

At some point, talk of TPS, fault tolerance, and risk management starts to sound like background. Especially for those who have already run exchanges, traded on the CME, and know what real infrastructure means. Let's save time and go over what's really important and what CVEX has already implemented:

- No “2 million TPS” on paper. We don't engage in a marketing carnival with fabulous numbers. Instead, honest benchmarks. StarkEx has 9,000 transactions per second in the lab, about 40 per market in production. We're aiming for 100,000 confirmed and verified transactions per second, taking into account all on-chain limitations. Because what matters is not how many you can send, but how many you can actually fulfill.

- No points of failure. We have a cluster of consensus engines. One node goes down, another one picks it up. There are redundant sequences. There are on-chain checkpoints. Even in a worst-case scenario, everything can be restored to the last confirmed state. You don't have assets stuck “in the server's RAM” because the server is no longer responding. Everything is backed up on the chain.

- KYB pools and credit slots. We get it: not everyone wants to trade against an anonymous “ape420.eth”. That's why the tiered order book: shared for everyone, nested only for verified participants. Want to know who you're trading with? Choose a KYB pool. What's more, you can guarantee other participants' trades by acting as a credit provider through a smart contract. Welcome to on-chain prime brokerage.

- Stock exchange risk management level: Automatic circuit breakers if the market is flying into the abyss; human oversight in case of bugs or Oracle glitches; and attention to the auction reopening after a shutdown. Not just “turn it back on” and watch the chaos, but collect all bids and set a fair price to restart.

- No fake reward mechanics. We do not reward wash trading. We do not incentivize the race for fake volumes. Only real liquidity: tight spreads, depth, live orders. All metrics are public, on blockchain or via API. Want a reward? Provide real market value. Want to screw volume with yourself? Walk by.

If you're institutional, you're not looking for a platform that looks pretty. You're looking for one where nothing falls apart at the moment. Where everything is verifiable. Where trades are closed by the rules, not by agreement. Where you don't have to take your word for it because you can look at the code.

CVEX is built to be just such an exchange, without compromise, with engineering you can trust, and with architecture neither you nor we will be ashamed of.

Wrapping Up

In a marketplace where a new exchange pops up every week with a new token, neon-gradient banding, and the promise of a “revolution,” it's easy to lose your bearings. Everyone talks about innovation, but few do the infrastructure, and even fewer do it right.

Institutional players don't fall for animated graphics. They don't want a token that supposedly “redefines liquidity.” They need a platform where orders are executed quickly, risks are controlled fairly, and all processes can be checked without human intervention.

CVEX is just such a platform.

- Speed that can be measured. Not “almost instantaneous” but with clear metrics for latency and throughput.

- Security that can be replicated. There are no promises, but a mechanism with reserves, auditing, and on-chain checkpoints.

- Motivation that works. Not rewards for trading into the void, but rewards for liquidity useful to the market.

This is not a toy exchange. It's a serious bid for what DeFi should be if it wants to move beyond speculation and become a real part of the global financial infrastructure.

We're not just trying to catch up with TradFi. We are rewriting the rules with open-source, transparent logic and engineering that can withstand any market conditions.

DeFi you can trust, that's where we're going. And now you know exactly how.

The Hidden Cost Every Prop Trader Faces: Collateral Inefficiency

In the fast-paced world of crypto trading, every dollar locked as collateral is a dollar that isn't generating alpha.

Whether you're running cross-asset hedges, basis trades, or exotic options strategies, today's centralized exchanges force you to over-collateralize positions — often by 50% to 70% more than needed. This hidden cost is even worse when trading across multiple venues with no unified risk management.

Example: On most CEXs, holding a long ETH and short SOL position still requires separate margin for each leg — even if the trade is structurally hedged. Go long BTC? You post $100. Go short ETH? Another $100. Even though BTC and ETH move together, you still need $200. With CVEX’s portfolio VaR, you might only need $50 — because the system recognizes offsetting risk across assets.

At scale, this collateral drag kills ROE (Return on Equity) for prop firms.

Meet CVEX: The First Decentralized Smart Clearing Layer for Derivatives

CVEX changes the game by introducing portfolio-margining — true capital efficiency — on-chain.

Built from the ground up for professionals, CVEX uses a deterministic Clearing Model based on Value-at-Risk (VaR) that captures real-time correlations and volatilities between assets.

Instead of treating every position in isolation, CVEX dynamically calculates how your entire portfolio behaves in market stress — lowering your required margin by 30-90% depending on your strategy.

Simple analogy: Trading long and short on a centralised exchange is like having a heater and air conditioner running at the same time — you’re burning energy on both sides. CVEX's Smart Clearing is like using a smart thermostat — it balances the temperature, so you only use the energy you actually need.

How CVEX Margining Works: Technical Power, Simple Outcomes

At the core of CVEX's advantage is its Portfolio Risk VaR model:

- Volatility and Correlation Inputs: CVEX uses historical covariance and a recency weighted volatility correlation to produce a correlation matrix, published by an oracle.

- Student-t Distribution Tail Risk: Models fat-tail events better than Gaussian VaR, critical for crypto’s high-volatility nature. Options use a Gamma Adjustment model to mimic Extreme Value Theory in a computationally achievable way.

- Deterministic Loss Optimization, Not Black-Box Sampling: Instead of relying on opaque Monte Carlo simulations or slow-converging MCMC methods like Metropolis-Hastings, CVEX directly computes the 99.5th percentile loss through an optimization approach — avoiding portfolio gaps and false confidence from curve-fitting noisy return data.

The result:

- Perfectly hedged positions → near-zero incremental margin.

- Highly correlated longs/shorts → margin slashed by 50%+.

- Pure risk positions → fair, proportionate margin based on volatility.

Example:

- A BTC call spread (buy $50K call, sell $60K call) on Deribit still demands over 50% margin.

- On CVEX, if structured properly, the system recognizes limited downside and cuts margin to 10-15% of notional.

Real impact:

- Leverage up without increasing systemic risk.

- Release up to 90% of your locked capital back into trading strategies.

- Avoid inefficient liquidations caused by one-position drawdowns.

Numbers Don't Lie: CVEX vs CEX vs OTC

| Scenario | Traditional CEX (e.g., Deribit) | OTC Bilateral Margin | CVEX Smart Clearing |

|---|---|---|---|

| Collateral Efficiency | Low (static IM/MM requirements) | Medium (depends on credit lines) | High (dynamic, portfolio-wide VaR) |

| Counterparty Risk | High (exchange bankruptcy risk) | High (no central clearing) | Zero (smart contract escrow) |

| Liquidity Access | Fragmented across markets | Limited (bilateral relationships) | Unified collateral pool |

| Transparency | Black-box risk models | Private agreements | Full on-chain audibility |

| Portfolio Hedging Recognition | Minimal | Some (if negotiated) | Dynamic cross-margining |

| Trading Hours | 24/7 but with manual interventions | Limited to human ops hours | Fully automated 24/7 |

TL;DR: CVEX isn't just better — it's quantifiably better.

Why Prop Traders Should Care Now: The TGE Advantage

In parallel with opening up for trading, CVEX is preparing its Token Generation Event (TGE) for the native $CVEX token.

Early participants in the ecosystem can:

- Stake $CVEX for fee rebates and trading discounts.

- Vote on risk parameters and product expansions via decentralized governance.

- Share in the growth of DeFi's first truly scalable clearinghouse.

- Participate in the token “jump ball” program whilst adding volume

TGE Timeline:

- Pre-TGE Community Program: April 2025 (Ongoing)

- TGE Launch: May 2025

- Platform Expansion (Options Clearing): June 2025

Early participants are positioning themselves at the ground floor of what could become the "CME Clearing" of crypto, but decentralized and global.

Final Thought: Crypto Derivatives Clearing Is Being Rewritten

If you're:

- tired of overpaying in margin,

- wary of counterparty risk,

- looking to maximize capital efficiency,

then CVEX isn't "just another DEX."

It's the clearing layer professional crypto trading has needed for years.

Don't just trade. Trade smart.

Join CVEX today — clear faster, trade bigger, and finally unlock your full potential.

Learn More:

Disclaimer:

This material is provided for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies and derivatives involves risk. Always do your own analysis.

The Hidden Burden: How Much Capital Are You Really Locking Away?

In professional crypto trading, collateral management is often the silent killer of performance.

You structure smart trades, hedge exposures, and time the market perfectly—yet your return on equity (ROE) looks anemic because too much capital sits idle as margin.

On most centralized exchanges (CEXs) like Deribit, Binance, and OKX:

- Each position demands isolated collateral.

- Cross-asset hedging receives little to no credit.

- Volatility shocks trigger unexpected margin calls even on risk-neutral portfolios.

This capital drag is massive.

Example: A prop trading desk running a delta-neutral BTC options book often locks 60-80% more collateral than its true risk profile would justify.

Multiply that by hundreds of positions, and you’re sitting on millions—frozen.

CVEX Changes the Game: Smart Clearing for Real Capital Efficiency

CVEX introduces decentralized smart clearing — a first for crypto derivatives.

Powered by a deterministic Value-at-Risk (VaR) margin engine, CVEX allows traders to:

- Post one collateral pool across all positions.

- Unlock 30% to 90% more usable capital.

- Achieve portfolio-wide cross-margining automatically.

How CVEX Margining Works

Imagine you’re balancing a see-saw.

- On CEXs, each side of the see-saw is weighed separately—no offset recognized.

- On CVEX, the full structure is assessed—weight that balances cancels out.

Technically:

- CVEX measures real-time volatilities and correlations.

- It models "worst-case" loss using heavy-tailed Student-t distributions (perfect for crypto's crazy volatility).

- It deterministically calculates the exact margin needed—no guesswork, no overkill.

Analogy: Trading on a CEX is like packing for a trip by carrying each item individually. Trading on CVEX is like using smart luggage that balances and compresses everything efficiently.

Real Numbers: CVEX Capital Savings in Action

| Trading Strategy | CEX Margin Requirement | CVEX Margin Requirement | Capital Freed |

|---|---|---|---|

| Delta-Neutral BTC Options | $1,000,000 | $200,000 | 80% freed |

| ETH Futures Hedge vs SOL Spot | $500,000 | $275,000 | 45% freed |

| Cross-Exchange Basis Trading | $750,000 | $350,000 | 53% freed |

Impact:

- More active positions with the same capital.

- Higher flexibility for hedging and risk management.

- Stronger liquidity provisioning (especially in options markets).

Why CVEX's Model is Built for Prop Traders

- Deterministic & Transparent: Same inputs = same outputs. No black-box margin games.

- Instant Solvency Proof: Collateral is held on-chain, auditable in real-time.

- Dynamic Portfolio Recognition: CVEX constantly updates margin based on live market dynamics.

- Risk-First Philosophy: Margining truly reflects portfolio risk, not arbitrary haircuts.

With CVEX, you don’t just post less collateral—you trade smarter.

Bonus: Position for the Future with CVEX's TGE

As CVEX revolutionizes clearing, the $CVEX Token Generation Event (TGE) offers traders an additional opportunity:

- Stake $CVEX for fee rebates and priority access.

- Vote on protocol governance to influence product expansion.

- Participate early in what could become the "decentralized CME Clearing" of crypto.

Timeline:

- Pre-TGE Campaign: Live now!

- TGE Launch: May 2025

Don't just free your capital—own a piece of the future of DeFi clearing.

Final Takeaway: Stop Letting Your Capital Sit Idle

If you're serious about:

- Scaling your trading strategies,

- Maximizing your ROI, and

- Protecting your downside with smarter margining,

then CVEX is the platform you've been waiting for.

The age of fragmented collateral and black-box margining is over. The future is deterministic, transparent, and capital-efficient.

Unlock your capital. Trade smarter. Move to CVEX.

Explore CVEX:

Disclaimer:

This material is provided for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies and derivatives involves risk. Always do your own analysis.

The Problem: Centralized Derivatives Markets Are Breaking

Crypto’s derivatives markets today are powerful—but fundamentally flawed.

Even the largest venues (like Deribit, Binance, and OKX) operate on models that traders are growing increasingly wary of:

- Opaque Risk Management: Margin requirements are set by private algorithms. Traders have no visibility into how their risk is assessed.

- Unregulated, but portrayed as regulated: Most large centralised exchanges have no market license, they are usually regulated for payments services, like Mica, but not markets, meaning they can’t offer real futures and options or proper clearing.

- Centralized Custody Risks: Your collateral is locked with the exchange—meaning hacks, mismanagement, or bankruptcy (remember FTX?) could wipe you out overnight.

- Lack of Real Cross-Margining: True portfolio margining barely exists. Most "cross-margin" is little more than pooling collateral without offsetting risk across assets to reduce the “locked” component. Enabling P&L to move between assets is not Cross-Margin.

Case Study: After the May 2021 crash, numerous traders reported having profitable positions forcibly closed due to rigid, poorly-optimized margin systems at major CEXs.

The status quo? A fragile ecosystem balancing on trust in a few offshore entities.

Traders deserve better.

The Solution: CVEX's Transparent Smart Clearing

CVEX introduces a new paradigm: deterministic, transparent, decentralized clearing.

Key upgrades over centralized platforms:

| Feature | Centralized Exchanges | CVEX On-Chain Clearing |

|---|---|---|

| Margin Transparency | Low (private risk models) | High (open-source smart contracts) |

| Custody Risk | High (exchange-controlled) | Zero (self-custody via smart contracts) |

| Portfolio Margining | Limited or superficial | Dynamic, cross-asset, VaR-based |

| System Solvency Proof | Audits (sometimes) | Real-time on-chain visibility |

Analogy: Trading on a CEX today is like flying blind in a foggy cockpit, hoping the plane is going the right way. Trading on CVEX is like flying with a full instrument panel — real-time data, verifiable outcomes, and no surprises.

How CVEX Guarantees Capital Efficiency and Fairness

CVEX doesn't just decentralize for the sake of it. It uses advanced financial engineering to materially improve trader outcomes:

- VaR-Based Margin Engine: Your entire portfolio is analyzed for correlations, volatilities, and tail risks to optimize margin requirements.

- Deterministic Calculations: Same inputs always lead to the same margin—no random re-margining shocks.

- Transparent Risk Parameters: Traders can independently verify how margin is calculated from published data.

- Self-Custody Collateral: Assets stay under your control, not in an opaque offshore account or an unregulated also opaque custody intermediary.

Real Results:

- Traders report 30-90% collateral savings compared to legacy systems.

- Lower margin requirements allow for larger trading sizes without additional risk.

- Liquidations happen only when mathematically justified

Example:

- On Deribit, running a BTC/ETH basis spread might require full margin on both legs.

- On CVEX, the model recognizes the hedge and cuts margin by up to 50%.

Why Traders Are Shifting: Real Trends

- Institutional desks are increasingly uncomfortable leaving 8-9 figures of collateral on lightly regulated exchanges.

- Prop shops demand cross-venue portfolio margining to maximize capital velocity.

- OTC desks seek transparent clearing that doesn't depend on trust in a single counterparty.

- Hedging by onchain Web 3.0 based DAOs and foundations happens via offchain OTC trading mechanics.

- Retail traders want the same protections and efficiency that professionals enjoy.

CVEX solves these pain points in one coherent protocol.

And with the CVEX Token Generation Event (TGE) approaching in May 2025, early adopters have the chance to shape and benefit from this new financial infrastructure.

Moving to CVEX: How to Get Started

- Explore the Protocol: Read the CVEX documentation to understand the margining engine.

- Sign Up for TGE Early Access: Position yourself to stake, vote, and earn alongside CVEX’s growth.

- Start Trading: Connect your wallet, deposit collateral, and experience truly capital-efficient, transparent trading.

The shift is already underway.

Will you stay in the centralized chaos—or move into on-chain clarity?

Learn More:

Disclaimer:

This material is provided for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies and derivatives involves risk. Always do your own analysis.

A Rare Moment in Crypto: Building the Infrastructure Layer

Every few years, a project comes along that doesn’t just offer another token — it builds essential infrastructure and defines a new category in Defi.

CVEX is doing exactly that.

With its upcoming Token Generation Event (TGE) soon in 2025, traders, investors, and builders have a unique opportunity to be part of the first truly decentralized clearinghouse for crypto derivatives.

Not another DEX. Not another CEX. CVEX is the clearing layer that unlocks the future of capital-efficient, transparent, on-chain trading.

Think of it like this: if Uniswap built the pipes for spot trading, CVEX is building the pipes for the $30+ trillion crypto derivatives market.

And you can be a founding participant.

What Makes CVEX Special: Real Innovation, Not Hype

Here's why CVEX is a genuine infrastructure play:

- Smart Clearing: True portfolio margining and cross-asset risk optimization—live on-chain.

- Deterministic Clearing: No opaque algorithms. Same inputs = same outputs. Fully auditable.

- Self-Custody Collateral: Collateral remains under trader control. No CeFi custody risks.

- Real-Time Solvency Proof: Overall risk visible on-chain 24/7.

In numbers:

- Collateral efficiency improved by 30-90% over CEX and OTC models.

- 77+ smart contracts deployed on Arbitrum One.

- First full DeFi clearinghouse for both futures and options.

Simply put: CVEX is clearing made for crypto’s speed, transparency, and global accessibility.

The CVEX Token ($CVEX): More Than Just a Token

The upcoming $CVEX token isn’t just for speculation. It’s integral to the system’s governance, economics, and growth.

Key Benefits for Token Holders:

- Fee Reduction: Stake $CVEX to get major discounts on trading fees.

- Governance Rights: Propose and vote on risk parameters, new product listings, incentive structures, and more.

- Protocol Rewards: Earn a share of protocol revenues (20% of total fees distributed via staking).

- Early Participation Perks: Access future airdrops, loyalty programs, and trading competitions.

Timeline: How to Get In Early

| Milestone | Date |

|---|---|

| Pre-TGE Community Program Launch | April 2025 (Live Now!) |

| Public TGE Launch (planned) | Q2 2025 |

| Options Trading Launch | Summer 2025 |

| OTC Give-Up Integration | Summer 2025 |

How to Participate:

- Register for Early Access: Sign up on cvex.xyz

- Join the Community: Get updates via Telegram and X (Twitter).

- Prepare to Stake: Plan to stake $CVEX to maximize your benefits.

- Spread the Word: Help build the future of decentralized derivatives infrastructure.

Pro Tip: Early users get exclusive advantages in staking and trading programs—be there before the crowd.

Why Timing Matters: The Strategic Land Grab

CVEX isn’t entering a saturated market—it’s entering a $30+ trillion clearing opportunity to enable defi to fight for a $1.4 quadrillion RWA market.

Traditional clearing (CME, ICE, EUREX) dominates TradFi. DeFi has nothing comparable yet.

In numbers:

- Crypto derivatives open interest already exceeds $450 billion (CEX and OTC combined).

- Clearing inefficiency ties up $60+ billion in excess margin.

- DeFi derivatives clearing = <2% of total crypto volumes—ripe for explosive growth.

Early movers in infrastructure plays — whether it was Uniswap, Aave, or Lido — captured huge market shares that became almost unassailable.

This is that moment for clearing.

Final Call: Build with CVEX

- Tired of opaque, centralized exchanges?

- Ready to trade with maximum capital efficiency?

- Want to shape the next layer of crypto financial infrastructure?

Then the CVEX TGE is your opportunity.

Be a founder of the future of DeFi clearing.

Join CVEX. Own the clearing layer.

Get Started Now:

Disclaimer:

This material is provided for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies and derivatives involves risk. Always do your own analysis.

The Big Problem: Why DeFi Options Have Been Broken

Options are one of the most powerful tools in trading. Yet in DeFi, options protocols have struggled to gain serious traction with professionals and institutions.

Why?

- Collateral Inefficiency: Traders often have to over-collateralize by many multiples of actual portfolio risk.

- Isolated Risk: In Defi no cross-asset margining; every option is treated in isolation.

- Support OTC: No Defi protocols to date support OTC trading. The dominant mechanic in the market across all options markets. Matching will happen bi-laterally, but clearing needs to be pooled.

- No Delta Hedge: No Defi protocol enables a delta leg to offset risk in the same margin pool.

- Custody Risks: CeFi venues require giving up asset control, exposing traders to counterparty failures.

- Poor Liquidity: Without efficient clearing, spreads are wide and sizing is small.

Case Study: A market maker providing liquidity on an AMM-based DeFi options platform needed 300% margin for a basic call spread. In TradFi or on Deribit, the same structure needed only ~20% margin.

In short: Options trading was expensive, risky, and inefficient in DeFi.

Until now.

Enter CVEX: Clearing Options the Right Way, On-Chain

CVEX brings institutional-grade clearing to DeFi options—without sacrificing transparency or custody control.

Here's how:

1. Smart Clearing with Dynamic Portfolio Margining

CVEX doesn't margin positions one-by-one. It uses a Value-at-Risk (VaR) approach across the entire portfolio.

- Long options offset short options.

- Hedged spreads get proper margin credits.

- Volatility surfaces dynamically adjust margin as market conditions change.

Result: Margin reflects actual portfolio risk, not arbitrary per-position haircuts.

Example: Running a BTC call spread (long $50K call, short $60K call)

- Traditional CEX margin: ~$25,000 locked.

- CVEX margin: ~$5,000 locked.

- 80% less collateral needed—freeing capital for other trades.

2. Deterministic Risk Engine

Margin calculations are transparent, auditable, and deterministic:

- No hidden "trust us" black boxes.

- Same inputs always produce the same margin outputs.

- Built-in risk oracles feed real-time volatilities and correlations.

This makes CVEX’s clearing system trustless yet verifiable—exactly what institutions demand.

3. Self-Custody Collateral Management

On CVEX:

- Traders retain ownership of their collateral at all times.

- Smart contracts only conditionally control assets (e.g., liquidation triggers), never through custodial wallets.

Compare that to centralized options venues, where a user's collateral can be frozen, misused, or lost during insolvency events.

In DeFi, control equals security.

Why Institutions and Pros Are Paying Attention

| Institutional Requirement | CEX / DeFi AMMs | CVEX |

|---|---|---|

| Collateral Efficiency | Poor | Excellent (30–90% freed) |

| Custody Risk | High (custodial) | Zero (self-custody) |

| Portfolio Margining | Very limited | Full VaR portfolio margining |

| Transparency | Low (black-box models) | Full on-chain audibility |

| Scalability for Large Trades | Constrained | Enabled via capital efficiency |

Example: An institutional desk clearing $50M notional of options saves up to $35M in margin when trading via CVEX instead of a traditional CEX or DeFi AMM. That’s real capital back into strategies, not sitting idle.

Key Points Institutions Care About:

- Proof of Solvency: All margin balances visible on-chain.

- Risk Governance: CVEX allows token holders to vote on risk parameters.

- Compliance Compatibility: Options to gate certain pools for KYC'd institutional access in the future if needed.

CVEX: Unlocking the Future of On-Chain Options

With CVEX's launch:

- Options trading becomes capital-efficient enough for serious players.

- Risk management becomes transparent and programmable.

- Collateral stays safe, decentralized, and always in your control.

- OTC Supported from Day 1.

This isn’t just an upgrade. It’s the missing infrastructure that makes real on-chain options liquidity possible.

Quote: "Clearing isn't just another trading venue feature. It's the foundational layer. Without smart clearing, options markets can't scale. CVEX fixes that." — Institutional Crypto Trader, 2025

The market trades OTC and will continue to trade OTC, on Orderbook trading will exist to support gamma adjustments and retail. Clearing will enable balance sheet exposure reduction, counterparty risk reduction and free up capital for trading whilst retaining the same workflow for complex price discovery.

How to Get Involved

- Start Trading: CVEX mainnet is live—trade futures today and get ready for options launch.

- Participate in the TGE: Stake $CVEX to shape the future and earn rewards.

- Build on CVEX: If you're a DEX, options venue, or OTC desk—integrate CVEX's clearing for your backend.

The on-chain options market is about to take off. CVEX is the launchpad.

Don't miss it.

Learn More:

Disclaimer:

This material is provided for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies and derivatives involves risk. Always do your own analysis.

If you are a trader and actively trade on crypto exchanges using leverage, you have probably encountered a number of unpleasant situations. For example, you want to open more positions, but suddenly you run out of spare funds. This is because every position requires collateral. And the more positions you have, the more locked capital you have. As a result, you cannot realize even half of your trading ideas. Only those that are directional are affordable.

This is a systemic problem of most exchanges Binance, Hyperliquid, OKX and others. They require a separate margin for each position. But there is a solution that already allows traders to trade many times more efficiently and without fear of liquidations.

If, after reading this article, you would like to try out your new knowledge in practice, we are waiting for you at CVEX!

Why Do Traders Lose Capital Efficiency?

On popular centralized and decentralized exchanges, margin is calculated separately each time a trader opens a position. This means that each trade is treated separately, and each one requires a different margin.

For example, you open Long on BTC for $10,000 with 10x leverage, the exchange locks $1,000. Do you want to open another position, say, on ETH? You need another $1,000 of collateral. The exchange does not take into account that these positions could hedge each other or reduce the overall risk. It just demands more money. And if the price goes against the trader, he will be liquidated, even if the whole portfolio is fine from a risk perspective.

So, traders lose:

- Freedom to identify and trade arbitrage opportunities

- Reduced returns on trades

- Money on liquidations

Is there any other way?

CVEX's Solution

At CVEX, we have solved this problem with smart clearing based on the Value at Risk (VaR) model. This means that we don't look at each trade individually, but rather we evaluate the entire portfolio as a whole.

If the positions balance the risks, we block only the minimum amount of capital. And if the market is volatile, but positions remain balanced, the user continues to trade without liquidations.

An example from one of the traders:

We didn't just recalculate margins. We've revised our entire approach to risk management. Here are the main differences:

| Feature | Traditional Exchanges | CVEX |

|---|---|---|

| Margin per position | ✅ | ❌ |

| Whole portfolio accounting | ❌ | ✅ |

| Mark-price liquidation | ✅ | ❌ |

| Free capital | 🔒 | 🔓 |

| Capital efficiency | ❌ | ✅ |

This is smart clearing, a system that takes real risk into account, not just locking capital.

What is Value at Risk (VaR)?

VaR is a statistical approach that calculates how much a portfolio can lose over time, given a given probability level. It takes into account:

- The overall composition of the portfolio

- Asset volatility

- Correlations between positions

If the risk is low, the collateral is kept to a minimum. In this way, liquidity can be maintained, and is less dependent on random market fluctuations, the risk of forced liquidations can be reduced.

Read more about the model in our whitepaper: https://docs.cvex.xyz/margin-and-liquidations/value-at-risk-model

Start Trading Smarter with CVEX

Most platforms keep your capital locked and your options limited. CVEX changes that.

Thanks to smart clearing and portfolio-based margining, traders now unlock capital they used to waste — and trade with confidence, not fear.

And that's just the beginning. In the very near future we will be holding a Token Generation Event (TGE). This means that a trader will not only be able to use the platform, but also become a part of it by gaining access to the token and growth opportunities of the CVEX ecosystem.

If you want to experience all the benefits of portfolio margin and smart clearing in practice, follow the link and connect your wallet to CVEX: https://app.cvex.trade/.

Stay tuned so you don't miss the TGE:

Telegram: https://t.me/cvex_xyz

Twitter: https://x.com/cvex_xyz

Discord: https://discord.com/invite/DRma7Z9BTz

Disclaimer:

This material is provided for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies and derivatives involves risk. Always do your own analysis.

CVEX is thrilled to introduce our very own Telegram Trading App. It’s a major step forward in bringing DeFi clearing infrastructure to the masses. With millions of traders and crypto enthusiasts already active in the Telegram ecosystem, we’re making crypto futures trading easier, more secure, and cost-efficient. Right where you are.

To help you get started, we’ve created a simple, step-by-step onboarding guide tailored specifically for our TG community.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice or a call to action. The features and functionalities described in this text may differ from those available in the actual application or may not be implemented at all. Always conduct your own research and trade responsibly.

Authorisation

Unlike traditional Telegram-based exchanges, our authorisation process follows a different sequence of steps. This approach allows us to maintain full compatibility with EVM and the Arbitrum blockchain, ensuring lower fees and faster transactions. Now, let's walk through the sign-up process.

Step 1: Create a PIN Code

After clicking “Sign Up”, you’ll be prompted to set up a PIN code. This PIN is your first layer of security, protecting your account from unauthorised access. Enter a secure PIN and confirm it to proceed.

Step 2: Set Up a Recovery Method

Forget complicated seed phrases! We've opted for a more familiar and user-friendly recovery method: security questions. If you ever need to restore access, simply answer a control question. Just like in the early days of the internet.

Example:

What was the name of your first pet?

→ Satoshi Liquidoto

You can find a visual guide in the screenshots below.

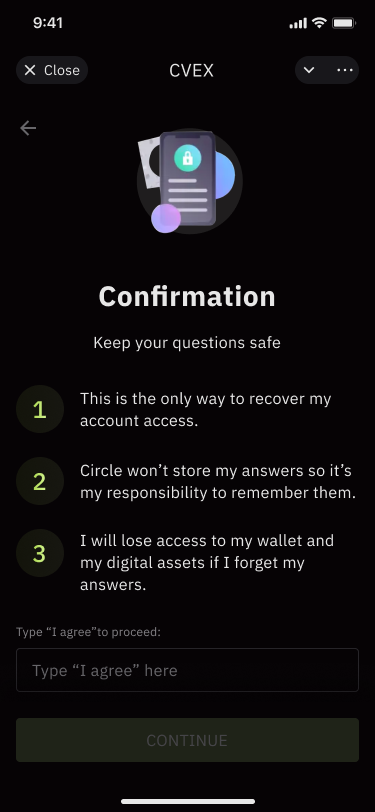

Step 3: Final Confirmation

⚠ Important: If you forget both your PIN and recovery answers, you will lose access to your wallet. We highly recommend writing them down and keeping them safe.

To finalise your setup, simply type “I agree” and click Continue on the confirmation screen.

Once you’ve completed these steps, you’re all set to start trading seamlessly within Telegram!

Depositing

To trade, you’ll need stablecoins, right? We’ve made depositing as effortless as possible. So, even if it’s your first time dealing with crypto, you’ll know exactly what to do.

You’ll have three options to deposit:

- USDC via Arbitrum One

- TON or USDT via TON network

- Almost every other crypto via ChangeNow network

- Fiat (coming soon)

Here’s how it works:

Step 1: Setting Up Your Deposit

Tap “Deposit” on the Home page. Next, choose your preferred payment method and enter the amount of crypto you’d like to deposit (ChangeNow and TON network) or just copy the address (using Arbitrum One). Whether it’s a stablecoin or any other crypto, we’ve got you covered.

Pay attention that your deposit will be automatically converted to USDC.

Step 2: Review & Proceed

Before sending funds and approving, double-check all transaction details. Then copy the address (for TON and Arbitrum One) and send the amount of funds you want to deposit. When it’s done, hit “I’ve sent funds” to move forward.

Step 3: PIN & Final Confirmation

For security, enter your PIN code (the one you created during authorisation). Then, wait a little bit until the blockchain proceeds your transaction.

When the transaction will be finished, you’ll receive a notification.

Please carefully read all the instructions on the screen during depositing. Features are subject to change without prior notice, so this guide may be irrelevant at some points.

Trading

Trading on CVEX’s Telegram app is designed to be effortless, even for first-time users. Just follow these three simple steps:

Step 1: Choosing a Contract

Head over to the “Trade” tab. At the top of the screen, you’ll find a list of available contracts. Select the asset you want to trade. Let’s use BTC as an example.

Step 2: Placing an Order

Currently, the app supports market orders for buying and selling. Simply choose whether you want to open a long or short position, then enter the amount of stablecoins you’d like to trade.

Step 3: Confirming Your Order

To finalise your trade, confirm the transaction in your wallet and enter your PIN code for security.

Once your first position is open, you can track your portfolio anytime in the “Home” tab. Happy trading!

With the launch of CVEX Mainnet, a new challenge begins—CVEXtopia. This interactive experience puts you in charge of Pepe the Trader, where your trading activity helps him grow stronger. Complete quests, earn XP, and move up the leaderboard to claim your place among the top traders before TGE.

Note: Please keep in mind that the CVEXtopia design or task list you see below may differ from the final version and is a simple illustration.

Step 1: Connect Your Wallet

To enter CVEXtopia, the first thing you need to do is connect your crypto wallet. This will allow you to access all features and start completing quests.

If you’re unsure how to connect, check out our Mainnet Guide (Step 1) via this link: https://cvex.xyz/post/cvex-mainnet-guide

Once you’re in, Pepe the Trader is waiting for you.

Step 2: Complete Quests

CVEXtopia is made up of several islands, each offering different challenges. The further you go, the harder the tasks become, but the rewards grow too. Your journey begins on the first island, which is unlocked from the start. Click "Enter" to access your first set of tasks.

Complete them to earn XP, level up Pepe, and move forward. Make sure to claim your rewards after completing each task, as progress won’t count unless you do.

Step 3: Take On Daily Tasks

Aside from the main quests, Pepe needs daily training to stay competitive. The Daily Tasks section offers fresh challenges every 24 hours, giving you extra XP and a chance to move up the rankings. Enter the tab, follow the instructions, and claim your daily rewards.

Just remember: tasks reset every day, so don’t miss out.

Step 4: Boost XP with Position Power

If you want to gain XP faster, the Position Power feature is your best bet. Open a position in any of the listed contracts and hold it for as long as possible. The longer you keep it open, the more XP you earn.

This is the quickest way to surpass your competitors and climb the leaderboard.

Step 5: Track Your Progress

After grinding through quests and challenges, you’ll want to see how you compare to others. Click on "Leaderboard" in the top-right corner of the screen to check your rank. Your position depends on the total XP Pepe has accumulated. The more challenges you complete, the higher you’ll climb.

Wrapping Up

The countdown to TGE is on, and the competition is heating up. Train Pepe the Trader, complete tasks, and secure your place among the top traders before it’s too late.

Trade smart, move fast, and claim your rewards in CVEXtopia!

⚠️ Disclaimer: Some CVEXtopia tasks may require the use of real funds. Crypto Valley Exchange is not responsible for any financial losses resulting from user actions. Always do your own research and trade responsibly.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice or a call to action. Some platform features described here may not be fully implemented at the time of reading or may not be implemented at all. Always conduct your own research and trade responsibly.

Welcome to the Future of Decentralised Trading!

The CVEX Mainnet is officially live and ready to welcome crypto traders worldwide! Whether you’ve been with us since the testnet days or are just discovering us now, CVEX is here to revolutionise decentralised derivatives trading.

At CVEX, we combine high leverage, advanced risk management, and a pioneering VaR margin system with a first-of-its-kind protocol for crypto futures clearing. Our platform bridges the gap between traditional finance and crypto, offering tools once exclusive to Wall Street traders. And we’re just getting started!

Step 1: Connecting Your Wallet

To start trading, you’ll need to connect your crypto wallet. CVEX supports hundreds of EVM wallets, so you can choose your favourite.

- Click "Connect Wallet" in the top-right corner of the terminal.

- A "Welcome to CVEX" window will appear, with instructions, terms of service, and a button to proceed.

- Select your wallet. For this guide, we’ll use MetaMask as an example.

- Confirm the connection in your wallet interface. This step ensures security, no funds are accessed during this process.

- Verify wallet ownership when prompted by signing a simple message.

- Once connected, your wallet address will appear in the top-right corner of the website.

Step 2: Depositing Funds

Depositing is quick and commission-free on CVEX:

- Click "Increase Balance" in the terminal's right panel.

- Specify the deposit amount and blockchain.

- Confirm the transaction in your wallet, and funds will appear in your account.

Important:

If you are depositing from any network other than Arbitrum—Base, Solana, Optimism, Etherium—then you need to take an additional step. After confirming the transaction in your wallet, go to the ‘Funding History’ tab and click ‘Claim’ on the transaction you are interested in. The ‘Claim’ button may appear within 20-40 minutes after confirmation.

Step 3: Placing Your First Trade

Trading on CVEX is streamlined for efficiency:

- Select your desired contract from the menu on the left.

- Set order parameters (e.g., long/short, limit/market, quantity, price).

- Review the impact on your portfolio in the preview panel.

- Click "Place Order" to execute your trade.

Step 4: Managing Positions

Keep track of your trades and performance easily by monitoring active trades in the Open Positions tab, where you can also update take profit or stop loss settings or close positions manually. Review your past trades and analyze performance in the Transaction History section. You can also manage pending orders in the Open Orders tab before they are executed.

Step 5: Withdrawing Funds

When you’re ready to withdraw, here’s how:

- Navigate to "Account Details" in the bottom-right corner.

- Click "Withdraw" and specify the amount and blockchain.

- Confirm the transaction.

Important:

1. Only USDC not used as margin can be withdrawn.

2. If you are withdrawing to any network other than Arbitrum—Base, Solana, Optimism, Etherium—then you need to take an additional step. After confirming the transaction in your wallet, go to the ‘Funding History’ tab and click ‘Claim’ on the transaction you are interested in. The ‘Claim’ button may appear within 20-40 minutes after confirmation.

Wrapping Up

CVEX offers much more than what’s covered here, from additional features to advanced settings for pro traders. Dive in, explore, and connect with our vibrant community to unlock the full potential of CVEX.

Happy trading!

.svg)