At CVEX, a leading decentralised derivatives exchange, we're here to demystify the concept of Crypto ETFs (Exchange-Traded Funds) and their pivotal role in the broader financial ecosystem.

This article will delve into the fundamentals of Crypto ETFs, offering you insights into various types, how they operate, and the pros and cons of integrating them into your investment portfolio. As the bridge between traditional investment mechanisms and the dynamic realm of cryptocurrencies, Crypto ETFs provide a structured gateway for investors to gain exposure to digital assets without the complexities of direct trading.

Whether you're a seasoned investor or new to the cryptocurrency scene, understanding Crypto ETFs will enhance your trading strategies and decision-making on platforms like CVEX. Join us as we explore the potential and intricacies of Crypto ETFs in the modern investment landscape.

What Are Crypto ETFs?

Crypto ETFs, or cryptocurrency exchange-traded funds, serve as a bridge for traditional investors to enter the world of digital assets without the complexity of managing cryptocurrencies directly. These financial instruments are designed to track the performance of one or more digital currencies or related technologies, such as blockchain, by being traded on conventional stock exchanges like any other ETF.

Essentially, Crypto ETFs allow investors to buy shares in a fund that represents an investment in cryptocurrencies. This method provides exposure to the crypto market's potential gains while mitigating the risks and technical challenges associated with setting up digital wallets and securing private keys. Investors can thus participate in the potential growth of digital assets through a familiar investment vehicle, without needing to engage directly with the underlying technology.

Crypto ETFs blend traditional investment strategies with access to emerging technologies, offering a straightforward and less daunting entry point into the crypto space.

Types of Crypto ETFs

Crypto ETFs come in various forms, each catering to different aspects of the cryptocurrency and blockchain landscape. Here’s a breakdown of the most common types:

- Bitcoin ETFs. These ETFs are primarily focused on tracking the price of Bitcoin, the leading cryptocurrency by market capitalisation. An example is the ProShares Bitcoin Strategy ETF (BITO), which mirrors the performance of Bitcoin through futures contracts rather than direct ownership of the digital currency.

- Ethereum ETFs. Similar to Bitcoin ETFs but centered around Ethereum, these funds aim to mirror the movements of Ether. Although direct Ethereum ETFs are not yet available on major U.S. exchanges, products like the Grayscale Ethereum Trust (ETHE) offer similar exposure through a fund structure.

- Blockchain ETFs. These funds invest in a portfolio of companies actively involved in developing and implementing blockchain technologies. The Amplify Transformational Data Sharing ETF (BLOK) is a notable example, providing investors with exposure to the blockchain sector beyond just cryptocurrencies.

- Bitcoin Miner ETFs. Targeting the mining sector of the Bitcoin ecosystem, these ETFs invest in companies that produce bitcoins through the mining process. The Valkyrie Bitcoin Miners ETF (WGMI) is an example, focusing on firms that generate revenue through mining activities.

The regulatory environment, especially for spot Bitcoin ETFs, remains a complex and evolving area. While futures-based Bitcoin ETFs have been approved, the U.S. Securities and Exchange Commission (SEC) has been cautious with spot Bitcoin ETFs, which would hold actual bitcoins rather than derivatives. The approval process has been stringent due to concerns over market manipulation and the lack of surveillance-sharing agreements with major cryptocurrency exchanges.

Comparative Table of Crypto ETF Types:

How Crypto ETFs Work?

Crypto ETFs provide investors with a pathway to participate in the cryptocurrency market without direct ownership of digital assets. These ETFs are structured to hold cryptocurrencies directly (spot ETFs) or use financial instruments like futures contracts to emulate the price movements of cryptocurrencies (futures-based ETFs).

Spot ETFs directly purchase and hold the cryptocurrency, allowing the ETF's performance to closely mirror the actual price movements of the digital asset it represents. In contrast, futures-based ETFs invest in futures contracts that speculate on the future price of cryptocurrencies, potentially introducing some deviation due to factors like roll costs and contango.

Investors can buy and sell shares of Crypto ETFs just like any other stock through traditional exchanges during regular trading hours. This process simplifies access to the volatile crypto market, providing a familiar, regulated framework for traditional investors to gain exposure to digital currencies.

Pros and Cons of Investing in Crypto ETFs

Investing in Crypto ETFs offers several advantages and disadvantages that investors should consider:

Advantages:

- Accessibility: Crypto ETFs simplify entry into the cryptocurrency market via traditional brokerage accounts, avoiding the complexities of crypto wallets and exchanges.

- Diversification: These ETFs often hold multiple cryptocurrencies or related securities, spreading risk across various assets.

- Liquidity: Traded on major stock exchanges, Crypto ETFs offer high liquidity compared to direct cryptocurrency transactions.

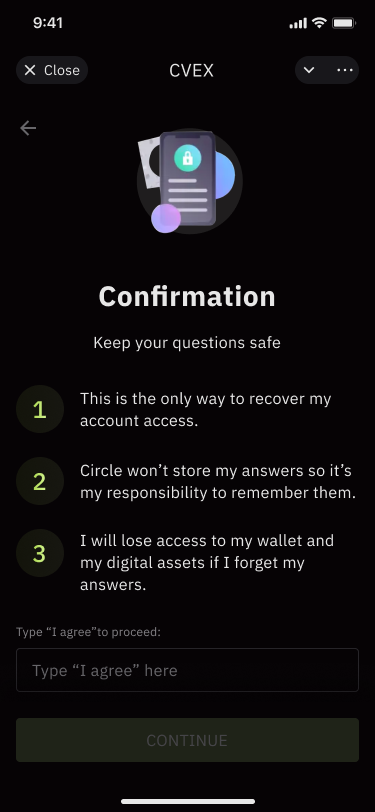

- Risk Mitigation: Investors are not required to handle security concerns like private key management, reducing the risk of theft or loss.

Disadvantages:

- Tracking Error: The performance of Crypto ETFs may not exactly match the underlying assets due to management fees or the mechanics of futures contracts.

- Counterparty Risk: Using derivatives introduces risks if the other party defaults on the contract.

- Regulatory Uncertainties: The evolving legal landscape can impact ETF performance and availability.

- Market Volatility: Cryptocurrency markets are notoriously volatile, affecting ETF valuations rapidly.

These factors make Crypto ETFs a compelling yet complex investment choice for those looking to diversify into digital assets with a traditional investment feel.

Crypto Trading or Crypto ETFs?

Investing in Crypto ETFs versus directly owning cryptocurrencies presents distinct differences, each appealing based on the investor's comfort with risk and desire for involvement in asset management.

Crypto ETFs provide a simplified, less hands-on approach to cryptocurrency investment. They offer traditional market trading hours in regulated environments and avoid the technicalities of cryptocurrency storage and security. This makes them an attractive option for traditional investors seeking exposure to crypto without the complexities of direct management.

Direct Crypto Investments involve purchasing cryptocurrencies like Bitcoin or Ethereum directly through exchanges. This method allows for 24/7 trading and potentially lower fees. It also offers excitement and deeper engagement in actively participating in the crypto market, including using platforms like CVEX for trading futures. It can be more thrilling and rewarding for those familiar with such environments.

Choosing between ETFs and direct investments often comes down to personal preference for involvement level, risk tolerance, and interest in the technology behind cryptocurrencies.

Wrapping Up

Crypto ETFs stand as a pivotal innovation, offering a bridge for traditional investors to enter the dynamic realm of cryptocurrency without the direct risks and complexities of managing digital assets. Whether opting for the regulated simplicity of ETFs or the direct engagement of owning cryptocurrencies, investors have diverse pathways to participate in the crypto economy.

As the landscape evolves, both methods will continue to offer unique benefits and challenges, making it crucial for investors to stay informed and consider their investment strategies carefully in this fast-moving market.

.svg)